Outsourcing the Endorsement Issuance Task in the Wholesale Insurance Industry

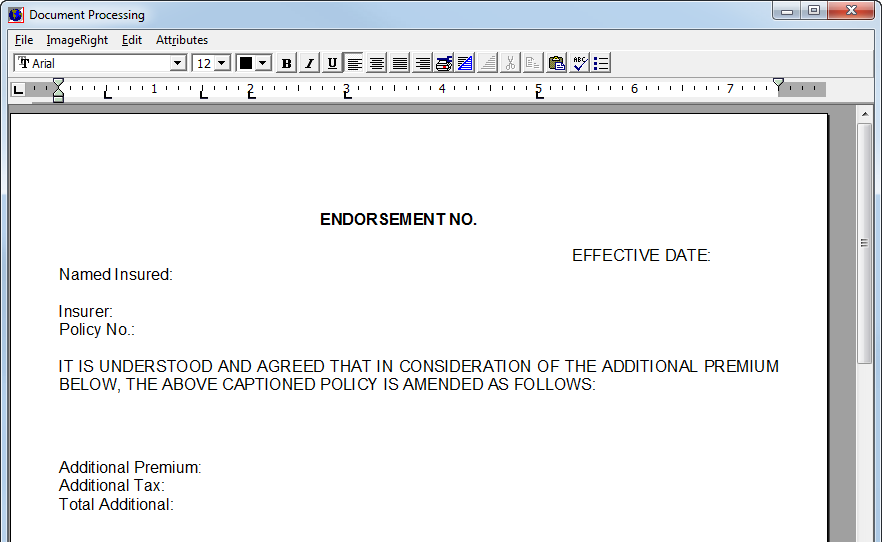

The endorsement issuance task is a critical process in the wholesale insurance industry. It involves making changes to an existing policy to add, remove, or modify coverage. Endorsements can range from simple changes like adding a new location or increasing coverage limits to more complex modifications like changing policy language or adjusting rates.

This process is crucial, it is important to ensure that it is done accurately and efficiently. However, managing the endorsement issuance task can be time-consuming and requires significant resources. This is where outsourcing can be beneficial for wholesale insurance companies.

Advantages

Outsourcing the endorsement issuance task can provide several advantages for wholesale insurance companies, including:

- Increased efficiency: By outsourcing the endorsement issuance task, wholesale insurance companies can leverage the expertise and resources of the outsourcing provider to complete the task more efficiently. This allows the company to free up internal resources to focus on other critical tasks.

- Improved accuracy: Outsourcing the endorsement issuance task to a provider with expertise in the process can help ensure that the endorsements are issued accurately and in compliance with regulatory requirements. This can help reduce errors and minimize the risk of costly mistakes.

- Flexibility: Outsourcing the endorsement issuance task can provide wholesale insurance companies with the flexibility to scale their resources up or down as needed. This can help companies manage fluctuations in demand and avoid the costs associated with maintaining a full-time staff.

- Cost savings: Outsourcing the endorsement issuance task can help wholesale insurance companies reduce costs associated with hiring and training internal staff, maintaining infrastructure and software, and managing compliance.

- Focus on core business: By outsourcing the endorsement issuance task, wholesale insurance companies can focus on their core business, including sales, underwriting, and claims management. This can help companies increase revenue and improve customer satisfaction.

Conclusion

In conclusion, outsourcing the endorsement issuance task can provide several benefits for wholesale insurance companies, including increased efficiency, improved accuracy, flexibility, cost savings, and the ability to focus on their core business. By partnering with a trusted outsourcing provider, wholesale insurance companies can ensure that the endorsement issuance process is managed effectively and efficiently.

Benefits

Outsourcing the endorsement issuance task in the wholesale insurance industry can provide numerous benefits to companies. By leveraging the expertise and resources of an outsourcing provider, companies can increase efficiency and improve accuracy in handling policy modifications. Outsourcing allows businesses to allocate their internal resources to other critical tasks, while relying on the specialized knowledge of the provider to ensure compliance and minimize errors. Additionally, the flexibility of outsourcing enables companies to scale their resources based on demand, leading to cost savings and a stronger focus on core business activities such as sales, underwriting, and claims management. Partnering with a reputable outsourcing provider empowers wholesale insurance companies to streamline the endorsement issuance process effectively and achieve optimal outcomes.

Reach out today to get the benefits of partnering with us. We are ready to listen to your needs, and tailor the process to the way you are working and not the other way around. We follow industry practice, analyse the process, suggest improvements, conduct continues education, perform quality control and protect your data. We pride ourselves in attention to detail, cost savings we bring, high-quality service, knowledge and teamwork. All of this gives you more time to grow your book of business.

Interested to learn more about our services? Find out more here…

Interested to read up to date news in insurance industry? You can read newest articles here…

INSoperations is a KPO – Knowledge Process Outsourcing company built on 10 years of experience in outsourcing business processes in the Wholesale and Specialty insurance market and P&C industry. We are headquartered in Denmark, and we have processing locations in Europe.

When you partner with us you can be sure that you will be working with a reputable company with Scandinavian mindset you can trust to handle your back office according to industry standards with low outsourcing rates.

Want to learn more about INSoperations? Read more here…